Three Points for Customer Oriented Business Reform in Financial Institution

A digital innovation company called GAFA is highly evaluated and occupies the top of the market capitalization ranking. It can be seen that GAFA’s net income is not much different from that of major domestic financial institutions and is evaluated not by the current financial value but by expectations for the future.

This is because it aims to solve the problems of customers and make a big change in society, not to pursue profits by solving their own problems. Problem-solving from the customer’s perspective will be required more and more in the future, and how the customer can be understood will determine the outcome of the company. Accenture surveys and analyzes consumer trends at the global level every year to transform companies that provide financial services. This paper introduces the possibilities of domestic financial institutions and the direction they should take, based on the latest trends, based on advanced cases.

Introduction

GAFA (Google, Amazon, Facebook, Apple) is a digital innovation company that has been driving creative destruction on a global scale in recent years and is overturning the common sense of existing businesses in various fields.

It has a great impact on the world market and the economy and society as a whole, such as monopolizing other than the top 5 in the 2017 market capitalization ranking of Fortune 500, a company ranking by the US economic magazine Fortune (*).

Did you know that the performance of GAFA and domestic financial institutions does not change so much when viewed by a certain standard?

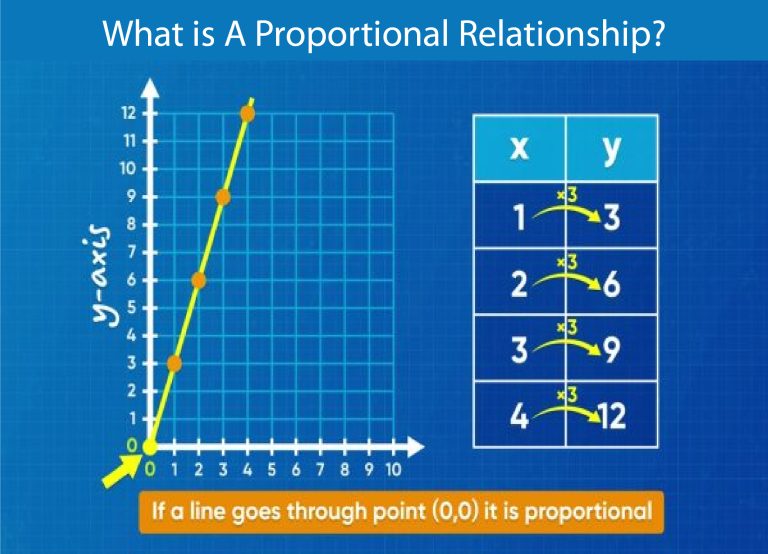

When compared based on the net profit (horizontal axis) in the graph below (excluding Apple), both are within the range of up to about 2 trillion yen, and some domestic financial institutions realize higher profits than Amazon. exist.

However, the situation changes dramatically when viewed based on market capitalization (vertical axis). In some cases, there is a big difference of more than 10 times between major domestic financial institutions with a maximum of about 10 trillion yen and GAFA’s huge market capitalization of about 60 to 90 trillion yen.

In other words, while Japanese financial institutions only have a market capitalization according to their financial value, GAFA has achieved a market capitalization that far exceeds that.

One of the factors that largely separates the two is the management vision as a company, the approach to the business, and the existence of the expected value that results.

For example, Amazon, which has the vision of being the most abundant product lineup on the planet and the company that can value customers the most on the planet, was originally founded as a book sales platform but did not aim to gain market share in the existing market. We have been pushing for the company’s top priority to explore what customers are looking for and continue to respond to their voices.

This approach, which prioritizes solving problems faced by customers and society over expanding the company’s business performance, creates expected value that greatly exceeds the financial value and enhances corporate value.

In the future, corporate management will not be able to bring about innovation that destroys existing markets and creates new markets only with the conventional values of profit expansion, cost reduction, and risk management from the company’s perspective.

As the example of GAFA symbolizes, the customer-oriented way of thinking of knowing customers, responding to customers, and growing business with customers is becoming indispensable for management and business in a new era.

Knowing Customers-The Latest Trends in Financial Services and Consumers

So what exactly does a customer-oriented approach mean for financial institutions, and how is consumer awareness of financial services changing?

An important hint is the results of this year’s Accenture Global Survey on Consumer Awareness of Financial Services. The survey, conducted on about 47,000 people in 28 countries (including about 2,000 Japanese consumers), highlights five key trends.

- Customers want the packaged value that meets their core needs

- Customers are increasingly looking for personalized offers from financial institutions

- Customers are willing to share data with financial institutions if they can get better advice and attractive services.

- Customers want a fusion of physical and digital channels

- Customer confidence in financial institutions is high and growing

What is interesting here is that there are different trends in the global and Japanese survey subjects.

For example, Japanese consumers are relatively less interested in packaged products and services provided by financial institutions and personalized proposals than global consumers and are somewhat reluctant to share data with financial institutions. be.

On the other hand, if you deposit your own data, the global provider trusts online payment providers (Paypal, etc.) at the same level as financial institutions, whereas in Japan, only financial institutions have high trust. The reliability of businesses other than financial institutions has a very low score.

While finance is an indispensable element of life for consumers, the expectation of current financial institutions to realize operational excellence of “faster”, “easier” and “lower price”. It stays at the value.

In order for financial institutions to become partners that are close to the challenges and needs of consumers throughout their lives, while preserving the trust that financial institutions have built up, they are not limited to financial services and are essentially resolved by customers. In the future, it will be increasingly required to be an entity that can deliver services and results in the units that we want you to do.

Responding to Customers Expanding Contact Points with Targets

One of the points to consider when understanding a customer and responding to their needs is the meaning of the word customer.

Customers here include not only customers who already have transactions with the company, but also potential customers who may do business in the future, and in some cases consumers and society as a whole.

In the new era of corporate management and business, it is indispensable to take an approach of understanding and responding to the needs of customers in a broad sense after grasping the whole picture.

Until now, the mainstream idea of many financial institutions was that the essential needs such as convenient and affluent living took the form of things and things, and only when they surfaced as needs for financial products and services, did they have contact with customers. ..

However, for non-financial companies that have recently entered financial services, there seems to be a method of seamlessly connecting to financial products and services by having contact with customers when their essential needs take the form of things and things. It has become.

In the future, it will be important to approach the deeper essential needs of customers and to connect them with joy and satisfaction for customers while having a wide range of contacts not only in daily life but also in extraordinary or various life stages. Will be.

Valora, a service offered by BBVA, a major Spanish bank, is an example of a financial institution that practices these efforts.

The company develops services based on the concept of “renting a house at a bank / buying a house at a bank” through data utilization and service integration of real estate companies. In this service, GPS location information and property information are linked, and when you hold your smartphone while walking in the city, information on rented and for-sale properties is displayed on the app.

You can also use the app to browse through the rooms of the property you are interested in, register them as favorites, or check detailed information. In addition, we will provide as much judgment material as possible before making a contract, such as providing information on changes in property prices, security in the surrounding area, neighborhood services (eg hospitals), etc. It meets the essential needs of customers who want to live in.

The service has been used by 1.7 million people in the first year, of which about 120,000 have applied for loans (*).

Nurturing with Customers Toward Customer Oriented Corporate Activities

Customers are increasingly seeking “results” with emotion rather than function. Therefore, even if a customer can be provided with a highly satisfying experience, the customer is switched to another company without hesitation unless it is continued.

That is why it is necessary to develop services together while reflecting the voices of customers in order to achieve the results that the company wants to achieve. And in order to put this approach into practice, it is necessary to change the overall corporate activities.

For example, in the past, many financial institutions used to build logic such as growth, short-term profits, and division of roles within an organization, starting from corporate issues and taking a large amount of time on a yearly basis. In the future, it will be indispensable to bring out products and services that embody the significance and vision of the company while fusing the ideas of human resources with various abilities and skills centered on customer issues.

It is also important to actively adopt an agile approach that repeats prototypes and trials. It is a unit of service that customers feel “value”, and various human resources such as business, technology. Design collaboration to develop and release products and services with a sense of speed.

And while incorporating feedback from customers. We will continue to improve and enhance it and continue to improve the customer experience. Based on this way of thinking, it is required to respond to all changes. Develop products and services together with customers.

10 Checklists That Financial Institutions Should Check

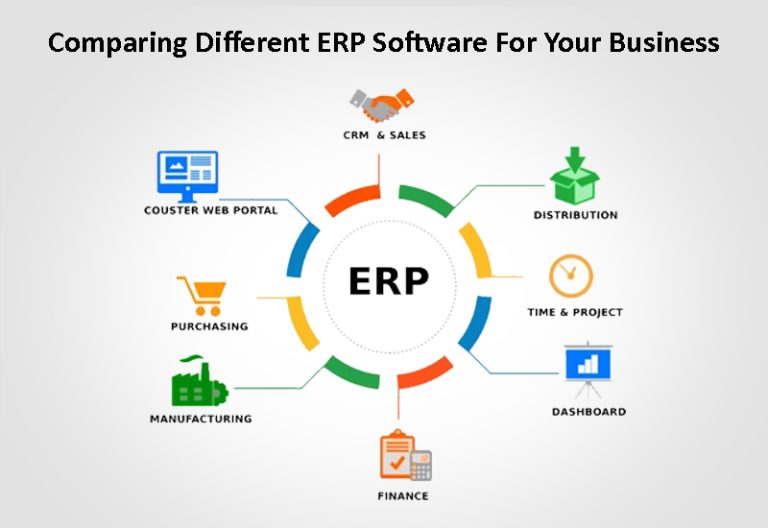

So far, we have explained customer-oriented businesses from the perspectives of knowing customers, responding to customers, and nurturing customers, but while feeling the need for initiatives, we will change the organization where to start reforms. Some may not know what to do or how to use the data.

First, use the checklist below to check the current status of your company’s efforts, and establish a mechanism and foundation to support whether the efforts that have been promoted with a “customer perspective” really meet customer issues. It will be clear if it is done and what action should be taken first.