The Link Between High-Yield Checking Accounts and Credit Scores

Having a good credit score is essential when it comes to making big purchases such as buying a house, car, or even applying for a loan. A good credit score shows that you are responsible with your finances, which makes it easier for lenders to trust you with their money. But did you know that having a high interest checking account could be a significant factor in improving your credit score? In this article, you’ll explore the link between high-yield checking accounts and credit scores.

What is a High-Interest Checking Account?

A high-yield checking account is a type of bank account that offers a higher interest rate than a traditional checking account. In addition to offering higher interest rates, high-yield checking accounts often come with additional benefits such as no monthly fees, free ATM access, and overdraft protection.

SoFi advisors suggest, “Get 50x the national APY avg.”

How High Interest Checking Accounts Affect Your Credit Score

Builds Financial Stability

Regarding credit scores, financial stability is a critical factor that lenders consider. Having a consistent balance in a high-yield checking account can be an indicator of financial stability. This shows that you can save and manage your money responsibly.

Furthermore, a high-yield checking account can help you build up your savings. You can earn more money on your deposits with a higher interest rate than traditional checking accounts. This extra money can be used to build up an emergency fund, pay off debt, or invest in the future.

Establishes Banking Relationship

Establishing a long-standing banking relationship can also positively impact your credit score. For example, lenders want to see that you have a history of responsible financial behavior, and having a consistent banking relationship is one way to demonstrate this.

You establish a relationship with a financial institution by opening a high-yield checking account and using it regularly. This relationship can lead to other benefits, such as lower interest rates on loans, credit cards, and other financial products.

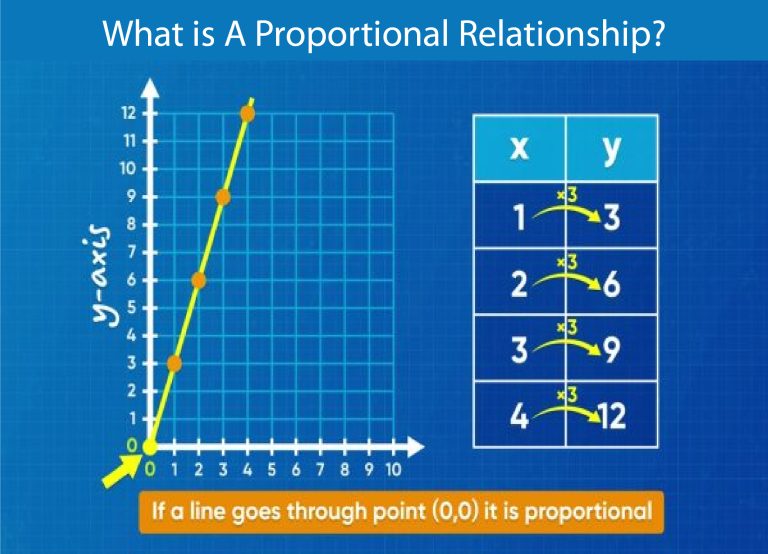

Increases Credit Utilization Ratio

A high-yield checking account also increases your credit utilization ratio. Your credit utilization ratio is the amount of credit you use compared to the amount you have available. Having a high-yield checking account gives you more money to pay off your credit card balances, which can improve your credit utilization ratio.

Reduces Overdrafts

Overdrafts can have a negative impact on your credit score. By having a high-yield checking account with overdraft protection, you can avoid overdraft fees and their negative impact on your credit score.

Provides a Source of Emergency Funds

Lastly, having a high-yield checking account can provide a source of emergency funds. In the event of an unexpected expense or emergency, having a high-yield checking account with a consistent balance can help you cover those expenses without resorting to using credit cards or taking out loans.

Having a high-yield checking account can positively impact your credit score. It can help to build financial stability, establish a banking relationship, increase your credit utilization ratio, reduce overdrafts, and provide a source of emergency funds. So, if you’re looking to improve your credit score, consider opening a high-yield checking account today!